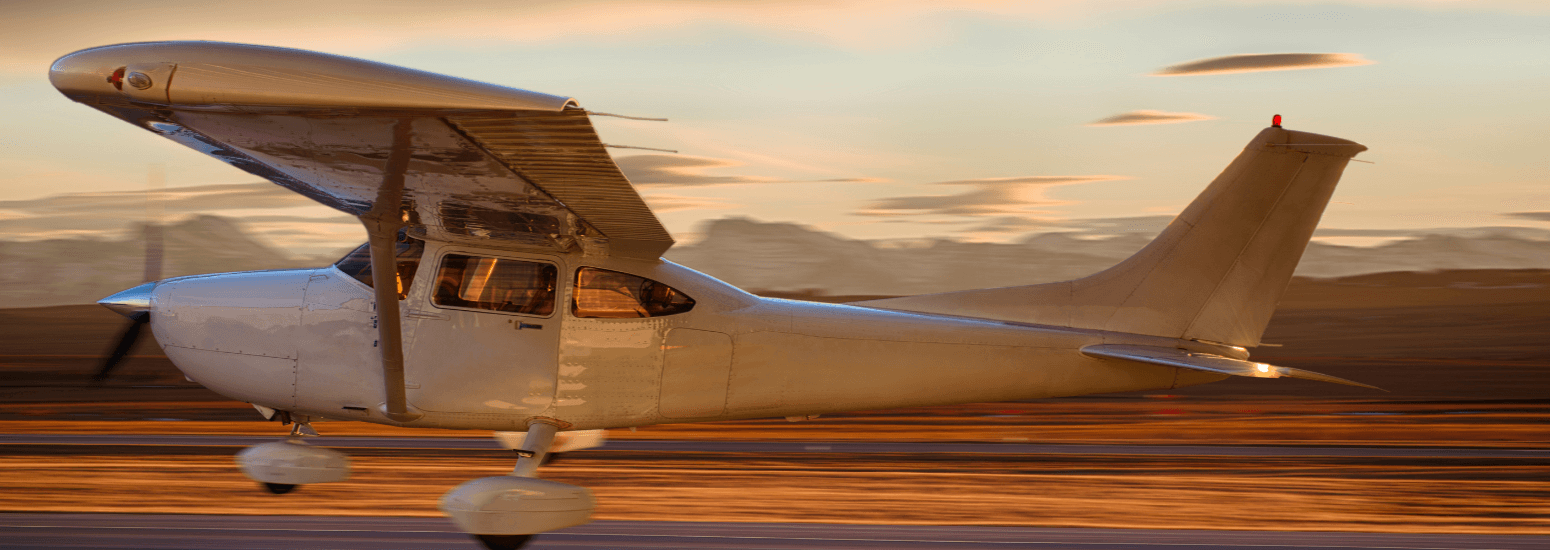

Personal Aircraft Insurance - Aircraft insurance, which provides liability and property insurance for aircraft. Aircraft insurance, also known as flight insurance, is available for many different types of aircraft, including standard, experimental and vintage aircraft as well as seaplanes.

While aircraft insurance generally covers the repair or replacement of damaged aircraft and parts, aviation accident insurance covers liability claims resulting from injury or loss of life.

Personal Aircraft Insurance

Just as boat owners can purchase boat owner's insurance to protect their boat or watercraft from damage, so can aircraft owners protect their property from damage. Aircraft insurance is necessary because claims or lawsuits arising from the ownership, maintenance or use of aircraft are generally excluded from the standard Commercial General Liability (CGL) form.

Business & Pleasure

Businesses that choose to use private aircraft in their operations must purchase aircraft insurance to cover aircraft liability exposure. This could be aircraft liability insurance or stand-alone non-owner aircraft liability and possibly additional aircraft liability. Third-party aircraft liability coverage is often provided, including coverage for hull (bodily damage) and medical payments. Aircraft policies are not standardized and vary widely. Some insurance companies offer policies that combine aircraft liability and hull with other aviation insurance policies such as aircraft product liability, airport liability, ground general liability, and hangar owners' liability.

The policy may also cover liability for the hangar used to store the aircraft as well as passengers' personal belongings. Insurance policies can cover injuries sustained while operating the aircraft, emergency landing expenses, and expenses associated with search and rescue operations.

The type of cover and the premium amount depends on the type of aircraft covered by the policy. Insurers will recognize that owner-built aircraft ('home-built aircraft') carry more risk than pre-assembled aircraft. Some policies provide first-flight coverage for homebuilt aircraft.

Insurance companies may provide different levels of coverage depending on whether the aircraft is used for recreational or commercial purposes. An aviation business may require coverage if it provides flight training services. A finance company may purchase aircraft insurance for its fleet of corporate aircraft.

The 6 Steps To Buying A Used Private Plane

Some insurance companies also provide insurance for aircraft that the operator leases rather than owns, since the operator could be liable for thousands of dollars in damages if something happens to the aircraft. Aircraft insurance is also available to organizations such as flying clubs whose members may participate in the use of one or more aircraft.

When you visit the Site, Dotdash Meredith and its partners may store or retrieve information on your browser, often in the form of cookies. Cookies collect information about your preferences and devices and are used to make the site work as expected, to understand how you interact with the site, and to show you ads relevant to your interests. You can learn more about our use, change your default settings and withdraw your consent at any time in the future by visiting our cookie settings, also found in the footer of this page. In the world of aviation, when something goes wrong, it's rarely a cheap problem or a cheap fix. This is especially true when it comes to private jets. If your hangar roof falls on your plane, who will foot the repair bill? The purpose of private aircraft insurance is to limit the potential financial liability and operating costs required to cover aviation assets, whether you are flying for business or pleasure.

Become an airplane or commercial pilot online with ease! Courses designed by industry experts can help you pass your FAA tests and take to the skies!

:max_bytes(150000):strip_icc()/Air-Ambulance-Insurance-Coverages-and-Examples-5755e31d3df78c9b469ccfb5.jpg)

Like the final pre-departure check of the flight plan, flight insurance is the protection of the pilot or aircraft operator in case of an incident. By purchasing an annual policy, private aircraft insurance provides financial protection against some of the risks associated with operating an aircraft. Generally, policies cover liability, health, legal protection as well as physical damage to the aircraft itself.

Russia: We've Got Hundreds Of Your Planes. What You Going To Do About It?

"Insurance is not a wasteful expense because it may only need to be written once, even though we have been paying for it for years," said Holland & Knight, an aircraft accident claimant. "Think of it as a protective foil to protect your personal assets from claims."

Some of the typical elements of coverage, according to the company, include airframe damage or destruction coverage, spare engine costs, property damage or loss of life coverage, and accidental coverage. The result of the war.

"It's not a question of whether or not to get airplane insurance, but who to get it from, how much coverage you need, where to get the best rates, etc.," says JetAdvisors.

"The purpose of a private aircraft insurance policy is to provide peace of mind and security that will help you recover financially in the event of an accident or incident," writes BWI Aviation Insurance.

Private Jet Insurance

Most general aviation is leased to pilots, which means that the companies that transport the aircraft must insure the rent paid by the pilot before takeoff. Policies can be purchased monthly or annually—and, in the case of SkyWatch aviation insurance, based on usage—for $5 a day.

When you consider the cost of private jet insurance, how much will it set you back? Short answer: it depends.

Premium costs are affected by many factors, including the type of aircraft you operate, your experience and track record as a pilot, where your aircraft is grounded or grounded and the safety record of the aircraft insured.

For example, liability coverage varies based on the cost of replacing the aircraft and what it would cost to purchase a similar aircraft.

The Top 5 Easiest Tailwheel Aircraft To Insure

According to NovaJet Aviation Group, the cost of the fee is about 14 percent of the aircraft's prime cost. "The accepted general liability is $200,000,000, but this can vary slightly depending on the age of the aircraft, type of ownership and use of the aircraft," said the Canadian Aircraft Management Company. That means for a Cessna Citation X business jet worth about $10 million, the annual fee would be about $30,000, the company said.

"Private aircraft insurance can range from $10,000 to $500,000 per year, depending on liability limits requested, aircraft use (private and commercial), hull coverage requested, pilot qualifications, etc.," reports BWI Aviation Insurance. .

"There are many variations, exclusions and differences in coverage between private aircraft insurance policies, always check the specific policy for coverage details," he advises.

Aircraft insurance covers property damage to the aircraft as well as other potential financial risks associated with operating the aircraft, such as liability for defects.

Smbc Joins List Of Lessors Pursuing Russian Claims Through The Courts

Ground Risk Hull Insurance provides protection against incidents or mishaps that occur when the aircraft is still on the ground and not moving forward. This coverage applies to storm damage such as vandalism or hail.

Ground risk hull insurance covers the period when the aircraft is in motion and provides protection for events that occur when the aircraft has not yet taken off, such as taxiing or takeoff.

When looking for coverage, specify whether the policy covers damage to the aircraft while it is in the air. Not all policies do this.

Liability coverage is usually included in a private aircraft insurance policy and protects you from financial risks if injury or property damage occurs while operating the aircraft.

You Need Insurance To Drive A Car...but Not An Airplane?

According to BWI, this coverage also generally provides legal protection for lawsuits arising from the operation of the aircraft. "Private aircraft liability coverage typically starts at $1,000,000 per occurrence and is limited to $100,000 per passenger," it said.

The first step in obtaining private aircraft insurance and determining the best level of coverage is to consult with an insurance company or broker specializing in aviation.

AssuredPartners Aerospace offers a wide range of aviation insurance for aircraft charter pilots, owners, instructors, flying clubs, drone operators and aviation businesses.

Private aircraft insurance is essential to limit financial risk when the unexpected happens.

How Much Does It Cost To Own A Small Plane?

Keeps you up to date with the latest aviation news. You can lock your subscription here.

The cost of private aircraft insurance varies depending on the aircraft, its age, pilot experience and rating level.

While the cost of aircraft insurance varies depending on policy coverage and type of aircraft, a light aircraft policy can cost between $1,200 and $2,000 per year, depending on the type of operation, according to Avian Insurance. Designed by the owner. According to jet insurance company BWI, private jet insurance can range from $10,000 to $500,000 per year.

Aircraft insurance is necessary to protect oneself against the financial risks of injury or property damage while operating the aircraft.

How To Use Your Airplane For Business

Aircraft appraisal online, free aircraft appraisal, aircraft appraisal services, aircraft appraisal cost, aircraft appraisal jobs, aircraft appraisal course, aircraft appraisal training, business appraisal, rolex appraisal, appraisal software, 409a appraisal, aircraft appraisal report

Post A Comment:

0 comments so far,add yours